If you’re an Apple Pay enthusiast, you might wonder whether Walmart, the retail giant, will accept this popular mobile payment option in 2023. This article will delve into the question and explore Walmart’s stance on mobile payments. Discover why Walmart has chosen not to adopt Apple Pay and what alternative payment methods they offer.

What is Apple Pay?

Apple Pay is a mobile payment service by Apple Inc. that allows users to make payments in person, in iOS apps, and on the web using their iPhone, Apple Watch, iPad, or Mac. It is designed to replace physical wallets and credit/debit cards, making transactions more secure and convenient.

Apple Pay supports most major credit and debit card providers, including Visa, MasterCard, and American Express. It can be used anywhere that accepts contactless payments, and if you see the contactless payment symbol or the Apple Pay symbol near readers at the checkout, they will accept Apple Pay.

Does Walmart take apple pay in 2023?

While Apple Pay has gained widespread popularity as a convenient and secure mobile payment method, Walmart has strategically decided not to incorporate it into their checkout systems. Instead, Walmart focuses on their own mobile payment solution called Walmart Pay. Understanding the reasoning behind this decision sheds light on Walmart’s customer-centric approach.

What is Walmart Pay?

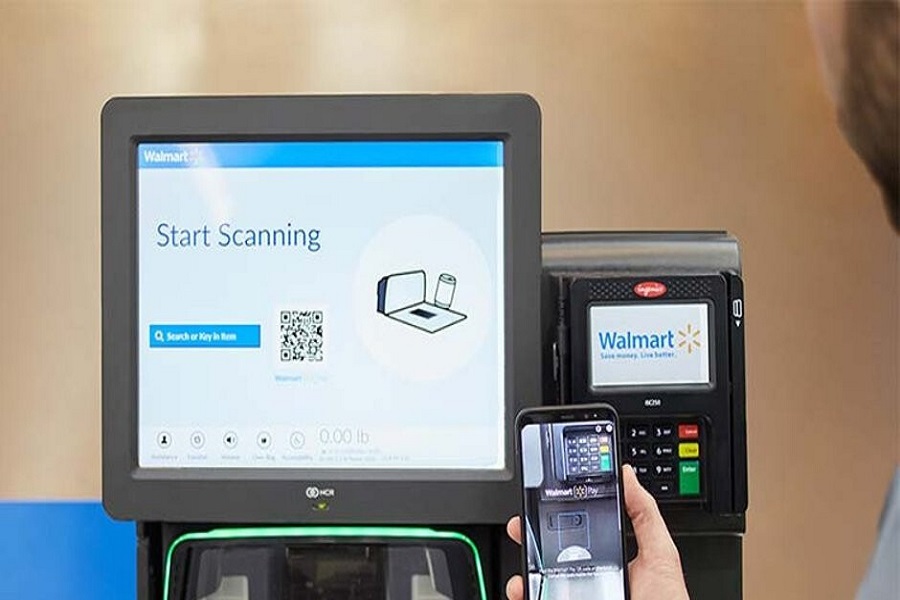

Walmart Pay was introduced by the retail giant in 2015 as an in-house mobile payment solution. This payment method offers customers a seamless and convenient experience shopping at Walmart stores. By linking their credit or debit cards to the Walmart mobile app, shoppers can purchase by scanning a QR code at the register.

What are the features of Walmart Pay?

Walmart Pay comes with a range of features designed to enhance the overall shopping experience. Customers can easily access digital receipts, store and use digital gift cards, and apply digital coupons. These added functionalities make Walmart Pay a comprehensive and efficient payment solution within Walmart’s ecosystem.

Reasons behind Walmart’s Decision

Although Walmart has not publicly disclosed the reasons for not accepting Apple Pay, several factors may have influenced their decision. Firstly, Walmart Pay allows the company to control the payment process, including transaction data. This aligns with Walmart’s commitment to providing a customer-centric experience while safeguarding customer information.

Does Walmart have Apple Pay in 2023?

In 2023, Walmart continues to exclude Apple Pay from their accepted payment options. Instead, the retail giant prioritizes Walmart Pay, credit cards, debit cards, and cash as their primary payment methods. By leveraging Walmart Pay, customers can enjoy a seamless and tailored payment experience specifically designed for Walmart’s ecosystem.

Walmart has always strived to maximize efficiency and minimize costs across its vast network of stores. By developing and utilizing its own payment system, Walmart avoids transaction fees typically associated with thirdparty mobile payment platforms like Apple Pay. This approach enables Walmart to keep prices low for its customers and maintain a competitive edge in the retail industry.

Conclusion

While Apple Pay enthusiasts may need to consider alternative payment options when shopping at Walmart, the company’s commitment to maintaining competitive prices and streamlining operations remains unwavering. Along with traditional payment methods, Walmart Pay offers customers a convenient and efficient payment experience.

Until next time, with another topic. Till then, Toodles.