In financial complexity, savvy savers are increasingly turning to high-yield savings accounts (HYSAs) to maximize their returns and secure their financial future. With interest rates fluctuating and financial institutions competing for customers, understanding the nuanced Industry of these accounts has never been more critical. Considering Apple team share this information about the current state of high-yield savings accounts, with a special focus on the Apple Card Savings Account and how it compares to other market offerings.

Recent Released: DoorDash Now Integrates With Reminders App on iPhone

The Evolving Industry of High-Yield Savings Accounts

What Drives Interest Rate Changes?

Interest rates for high-yield savings accounts are not static. They are dynamic financial instruments influenced by several Basic factors:

- Federal Reserve Monetary Policy: The federal funds rate, which changes approximately every six weeks, is the primary driver of savings account interest rates. When the Federal Reserve adjusts its benchmark rate, banks typically respond by modifying their HYSA rates.

- Economic Conditions: Market competition, inflation, and overall economic health play significant roles in determining how banks set their interest rates.

- Institutional Strategy: Banks use competitive interest rates as a tool to attract new customers and retain existing ones.

Comparative Analysis of High-Yield Savings Accounts

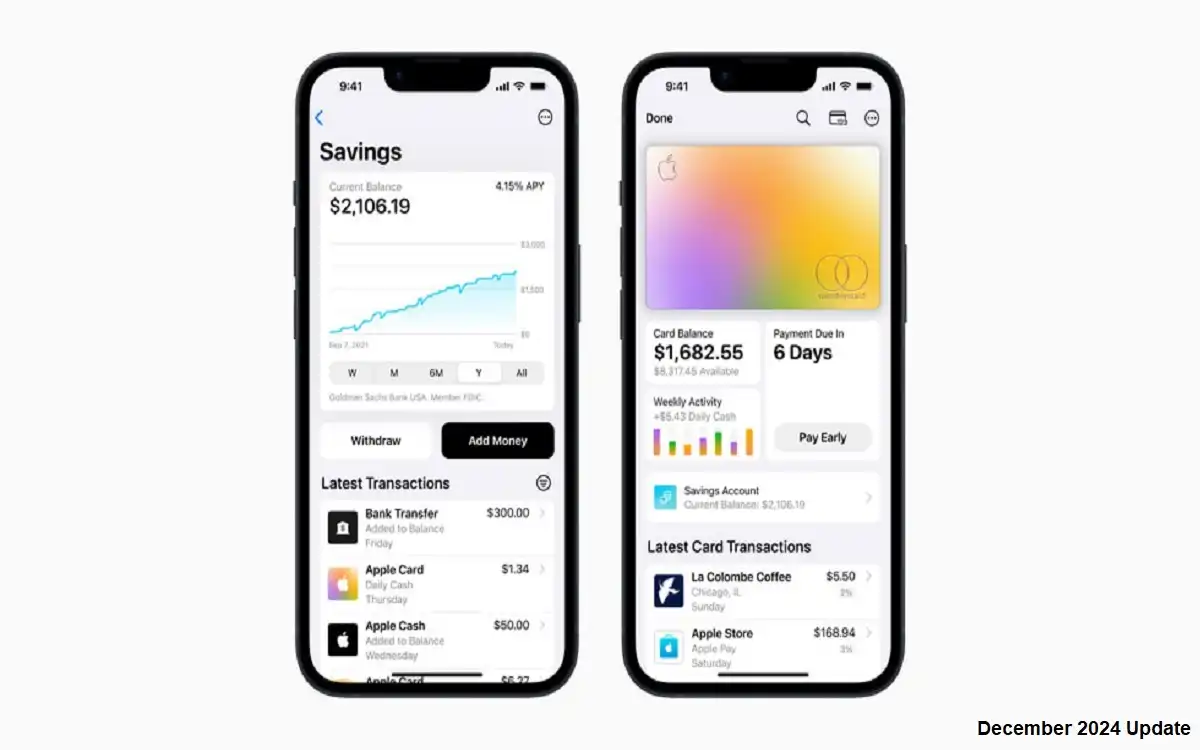

Apple Card Savings Account: A Closer Look

As of October 11, 2024, the Apple Card Savings Account offers an Annual Percentage Yield (APY) of 4.10%. This represents a notable reduction from its initial launch rate of 4.15% in April 2023, marking the third rate cut in 2024.

Competitive Industry Comparison

Here’s a comprehensive breakdown of current high-yield savings account offerings:

| Bank Account | APY | Minimum Deposit | Basic Features |

| BrioDirect High-Yield Savings | 5.35% | $5,000 | High yield, substantial minimum deposit |

| Bread Savings High-Yield Savings | 5.15% | $100 | Competitive rate, lower entry threshold |

| Bask Bank Interest Savings | 5.10% | $0 | No minimum deposit requirement |

| Apple Card Savings Account | 4.10% | $0 | Integrated with Apple ecosystem |

| Ally Bank Savings | 4.25% | $0 | No minimum balance, digital-first |

| Discover High-Yield Savings | 4.10% | $0 | No monthly fees |

| American Express High-Yield Savings | 3.90% | $0 | Established financial brand |

Basic Considerations for Choosing a High-Yield Savings Account

Beyond Interest Rates

While APY is crucial, several other factors should inform your decision:

- Account Accessibility: Consider how easily you can manage and transfer funds.

- Additional Features: Look for accounts with no monthly fees and low minimum balance requirements.

- Integration: Some accounts, like the Apple Card Savings Account, offer seamless integration with existing financial ecosystems.

Understanding Rate Volatility

High-yield savings account rates are inherently variable. They can change:

- In response to Federal Reserve meetings

- Based on broader economic conditions

- As part of banks’ competitive strategies

The Bigger Economic Picture

The current savings account Industry reflects broader economic trends. While the national average savings account rate hovers around 0.59%, high-yield savings accounts offer significantly better returns. However, rates above 5% are not uncommon in the current market.

Strategic Implications for Savers

- Stay Informed: Regularly monitor your account’s interest rate.

- Be Flexible: Don’t hesitate to switch accounts if better rates become available.

- Consider Total Value: Factor in convenience, account features, and ease of use alongside pure interest rates.

Finally

High-yield savings accounts represent a dynamic financial tool for modern savers. While the Apple Card Savings Account offers a competitive 4.10% APY with unique Apple ecosystem integration, the market provides numerous alternatives with potentially higher yields.

Your ideal savings account depends on your individual financial goals, preferences for digital integration, and desire for maximum returns. By staying informed and adaptable, you can make strategic decisions that optimize your savings potential.

Recommended Next Steps

- Compare multiple high-yield savings accounts

- Consider your personal financial needs

- Don’t be afraid to explore options beyond your current bank

- Review your savings strategy periodically

Remember, in the world of personal finance, knowledge and flexibility are your greatest assets.

For More Apple Tech Update Visit Considering Apple