The Apple Card Savings Account, a collaborative offering from Apple and Goldman Sachs, has recently undergone significant changes that have caught the attention of both existing account holders and potential customers. As we approach the end of 2024, The ConsideringApple expert analysis examines the latest developments, the competitive industry, and whether the account still presents a compelling option for savers.

Recent Released: DoorDash Now Integrates With Reminders App on iPhone

Recent Rate Adjustments: Understanding the Trend

The Apple Card Savings Account has experienced multiple interest rate modifications throughout 2024, reflecting broader economic shifts and Federal Reserve policies. The most recent adjustment on December 4, 2024, saw the annual percentage yield (APY) decrease to 3.90% from its previous rate of 4.10%. This marks the fourth rate reduction this year, representing a significant shift from the account’s peak rate of 4.50% in January 2024.

Here’s a detailed timeline of the account’s interest rate journey:

| Period | APY Rate | Change |

| April 2023 (Launch) | 4.15% | Initial Rate |

| January 2024 | 4.50% | +0.35% |

| April 2024 | 4.40% | -0.10% |

| September 2024 | 4.25% | -0.15% |

| October 2024 | 4.10% | -0.15% |

| December 2024 | 3.90% | -0.20% |

Factors Driving Rate Changes

Several key factors have influenced the successive rate adjustments:

Federal Reserve Policy

The primary driver behind these rate changes has been the Federal Reserve’s monetary policy decisions. The recent rate cuts align with the Fed’s broader strategy of adjusting interest rates in response to economic conditions, with a notable rate reduction in November 2024 affecting savings rates across the banking sector.

Market Dynamics

The competitive industry of high-yield savings accounts plays a crucial role in rate determination. Financial institutions continuously adjust their offerings to maintain market competitiveness while managing their cost structures.

Economic Indicators

Inflation rates and overall economic health significantly impact interest rate decisions. These macroeconomic factors influence both the Federal Reserve’s policies and individual banks’ rate-setting strategies.

Competitive Analysis: How Does It Stack Up?

While the Apple Card Savings Account’s current 3.90% APY represents a decline from its previous rates, it’s essential to evaluate this offering within the broader market context. Here’s how it compares to other leading high-yield savings accounts:

| Institution | Current APY | Minimum Deposit | Notable Features |

| CIT Bank | 4.85% | $5,000 | Higher minimum requirement |

| Popular Direct | 4.85% | $100 | Competitive rate with low minimum |

| UFB Direct | 4.81% | None | No minimum balance |

| TAB Bank | 4.76% | None | Easy access |

| Bask Bank | 4.75% | None | User-friendly platform |

| Apple Card Savings | 3.90% | None | Daily Cash integration |

Distinct Advantages of the Apple Card Savings Account

Despite offering a lower APY than some competitors, the Apple Card Savings Account maintains several unique advantages that may appeal to specific users:

Seamless Integration

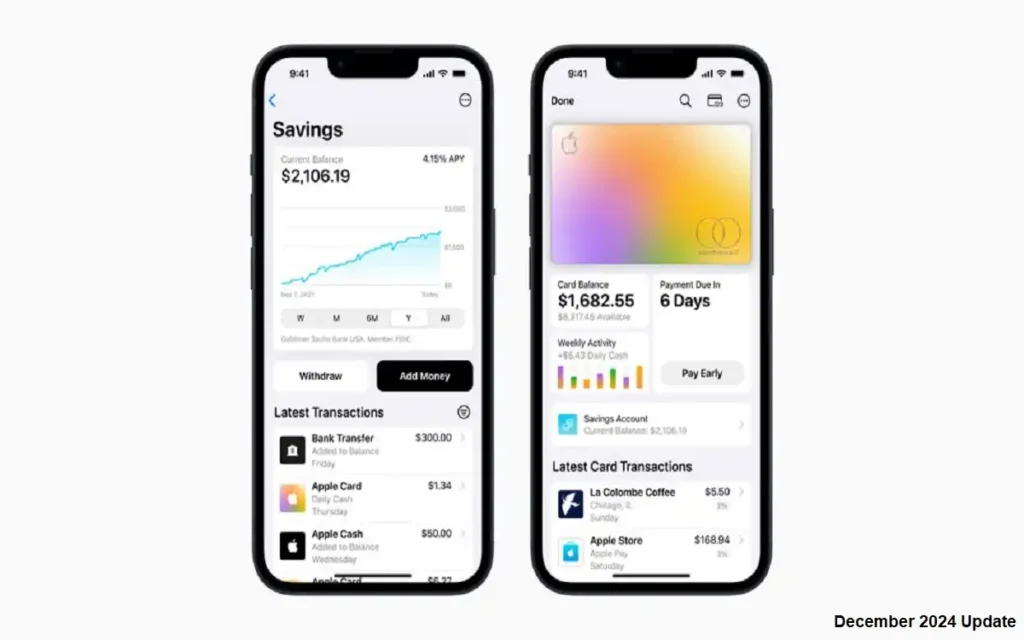

The account’s integration with the Apple ecosystem, particularly the Wallet app and Daily Cash rewards, provides a streamlined experience that competing banks can’t match. Users can automatically direct their Daily Cash rewards into their savings account, creating an effortless saving mechanism.

Zero Barriers to Entry

The account stands out for having no minimum deposit requirements, no monthly fees, and no balance restrictions. This accessibility makes it particularly attractive for new savers or those preferring a straightforward banking experience.

Enhanced Security and User Experience

Built on Apple’s reputation for security and user-friendly design, the account offers a sophisticated yet simple banking experience through the familiar Wallet app interface. The recent increase in maximum balance limits to $1,000,000 demonstrates the platform’s evolution to accommodate higher-value savers.

Future Outlook and Considerations

As we look ahead, several factors will likely influence the future direction of the Apple Card Savings Account:

Interest Rate Environment

The Federal Reserve’s monetary policy decisions will continue to play a crucial role in determining future rate adjustments. Account holders should stay informed about broader economic trends that might impact their returns.

Competitive Pressure

As other financial institutions continue to offer competitive rates. Apple and Goldman Sachs may need to balance maintaining attractive yields while ensuring sustainable operations.

Platform Evolution

The potential for additional features and improvements to the existing platform could enhance the account’s value proposition beyond mere interest rates.

Is It Still Worth It?

The Apple Card Savings Account, despite recent rate reductions, remains a compelling option for specific users. Particularly those already integrated into the Apple ecosystem. While the current 3.90% APY may not be the market’s highest.

The combination of competitive returns, zero fees, seamless integration with Daily Cash rewards, and user-friendly management through the Wallet app creates a valuable package for many savers.

For users prioritizing the absolute highest yields, alternative high-yield savings accounts might be more appropriate. However, the Apple Card Savings Account’s unique blend of features, particularly its integration with the Apple ecosystem and Daily Cash rewards. Continues to offer significant value for existing Apple Card users and those seeking a streamlined, saving experience.

The decision to choose or maintain an Apple Card Savings Account should ultimately depend on individual priorities. Whether the convenience and integration of the Apple ecosystem outweigh potentially higher returns available elsewhere. As the financial industry continues to evolve, staying informed about rate changes and alternative options remains crucial for making optimal saving decisions.

For More Apple Tech Update Visit Considering Apple