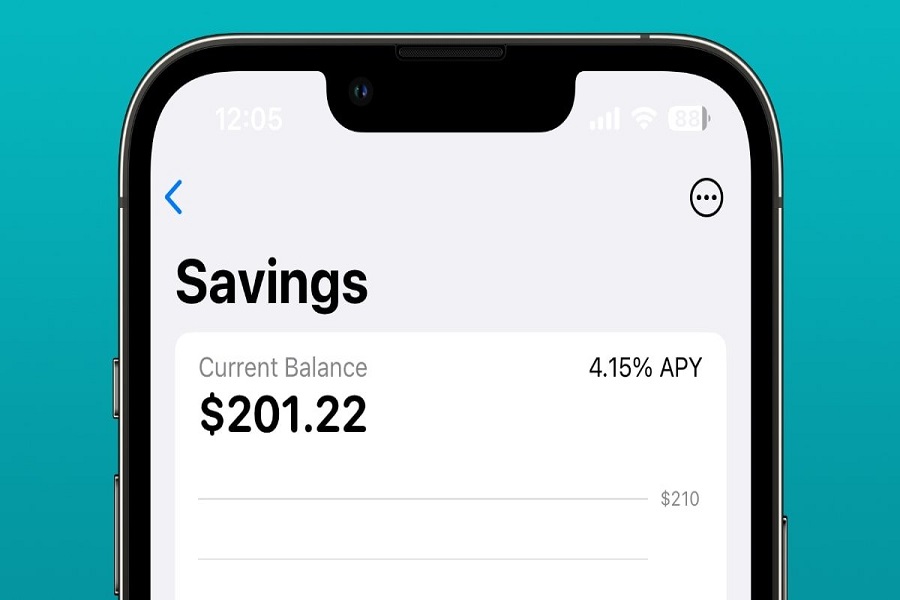

To take advantage of Apple’s 4.15% annual percentage yield (APY) interest rate with no fees on their savings account, I was curious about how to set it up Apple Savings account on my iPhone. Recently, it was reported that the interest rate offered by Apple Savings is higher than that of many Indian banks, making it an attractive option for those looking to save. Since Apple partnered with Goldman Sachs to offer this service, people around the world have been eager to sign up.

As there is growing interest from users around the world on how to set up and use an Apple Savings account, we are here to guide you through the process of getting your own Apple Savings account.

How to set up an Apple savings account

To set up an Apple savings account, Apple Card users can follow these steps:

- Open the Wallet app on their iPhone.

- Tap on their Apple Card.

- Tap the three-dot “More” button and select Daily Cash.

- Tap “Set Up” next to Savings.

Users can then start building their savings account using Daily Cash rewards earned when using the Apple Card to make purchases. There are no fees, minimum deposits, or minimum balance requirements for the account. The account is administered by Goldman Sachs and offers a 4.15% APY.

How To Add Money To Apple Savings Account

- Open the Wallet App. On the first page, there should be a button with your savings balance.

- Inside the savings page, tap the Add Money button to add money from your connected bank account.

- You can also withdraw from your savings account to your linked bank account or your Daily Cash account.

- There’s no limit on how many transactions a user can make to take money out or put funds into the savings account.

How to Withdraw Money from an Apple Savings Account

To withdraw money from an Apple savings account, users need to open the Wallet app on their iPhone and tap on the Apple Card. Then, they need to select the Savings account and tap on Withdraw. After that, they can enter the amount they want to withdraw and confirm the transaction. Withdrawals can be made at any time through the dashboard of the account, by transferring them to a linked bank account or their Apple Cash card, with no fees. The Apple savings account has no monthly fees, no minimum deposits, and no minimum balance requirements.

Benefits of Using an Apple Savings Account

- The account offers a high APY of 4.15% with no fees, minimum deposits, or minimum balance requirements.

- Apple Card users can set up the account directly from the Wallet app on their iPhone and can build their savings account using Daily Cash rewards earned when using the Apple Card to make purchases.

- The account provides a seamless factor for Apple enthusiasts who are already using the company’s phone, credit card, or buy now, pay later service.

- The account offers a more holistic financial-service experience under the Apple umbrella for its customers.

Have you set up an Apple Savings account? Did you find this article helpful? Do you need more tips on how to use your Apple Savings account? Please feel free to ask for help or share your feedback in the comments section.